RBI's Strategic Decision: Maintaining Repo Rate at 6.5%

A Steady Approach to Monetary Policy

In a recent monetary review meeting, the Reserve Bank of India (RBI) made a pivotal decision to maintain the policy repo rate at 6.5 percent. This marks the fifth consecutive time the RBI has held the rate steady, indicating a deliberate and calculated approach to India's economic stability and growth.

Understanding the Repo Rate

The repo rate is a critical tool in monetary policy, used by central banks to control inflation and stimulate economic growth. By keeping this rate unchanged, the RBI signals a balanced stance towards economic conditions, considering factors like inflation, economic growth, and global economic trends.

Implications for the Indian Economy

The unchanged repo rate has several implications for the Indian economy. It suggests a stable interest rate environment, which is beneficial for both borrowers and investors. Steady rates mean predictable loan costs, encouraging businesses to invest and expand, thereby fostering economic growth.

RBI's Vision for Economic Stability

The RBI's decision reflects its commitment to ensuring economic stability in India. By maintaining a steady repo rate, the RBI aims to balance inflation control with the need to support economic growth. This approach is especially crucial in the current global economic climate, where uncertainties abound.

In Conclusion: A Promising Outlook

The RBI's decision to keep the repo rate unchanged is a promising indicator of India's economic outlook. This measure fosters a stable financial environment conducive to growth and stability. It reflects the central bank's adeptness in navigating complex economic landscapes and its commitment to driving India towards a prosperous future.

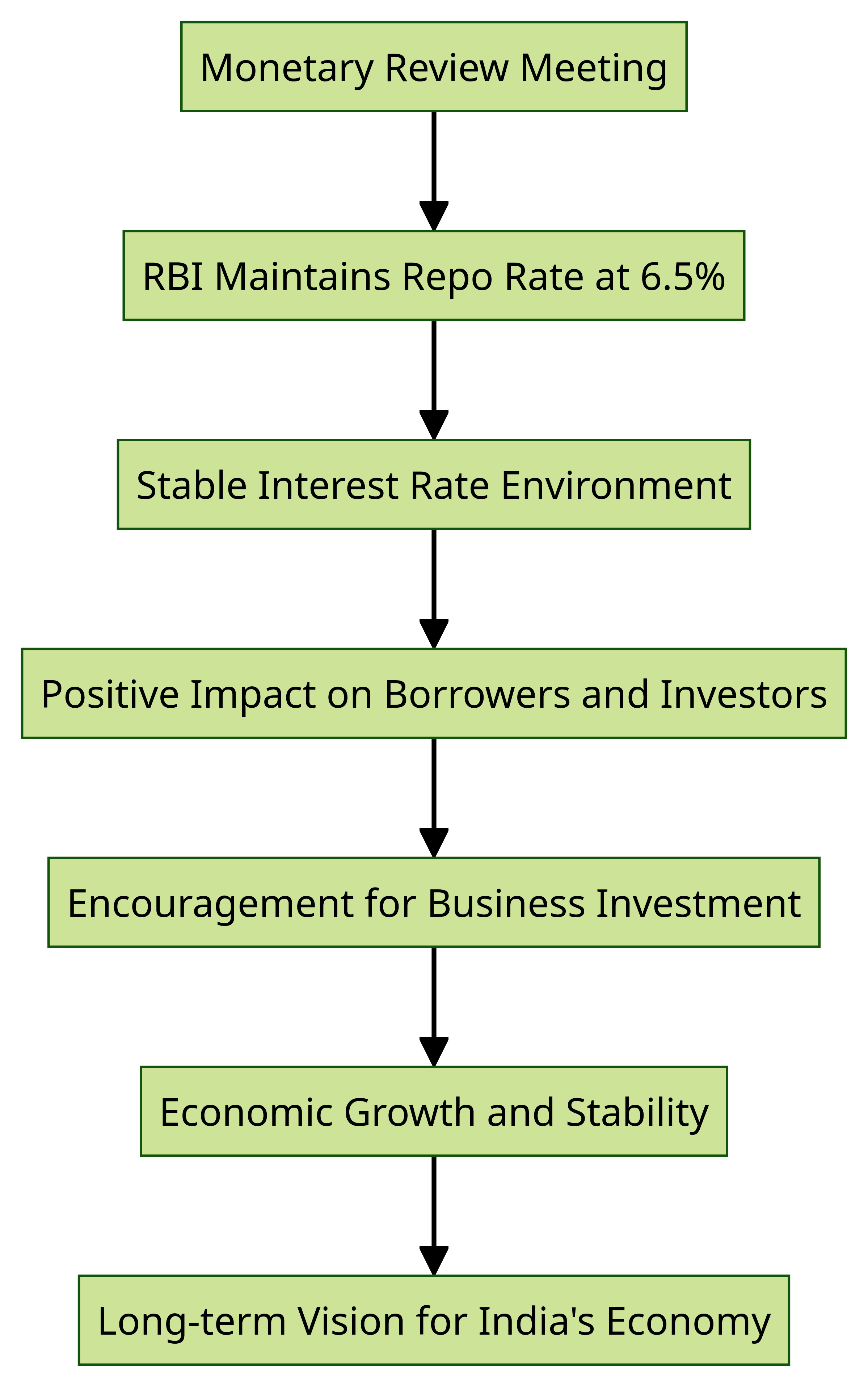

Charting the Impact

This diagram illustrates the pathway from the RBI's decision to its long-term economic impact, highlighting the strategic nature of maintaining the repo rate.