Today's Current Affairs 4 May 2023

-1682478100940.jpeg)

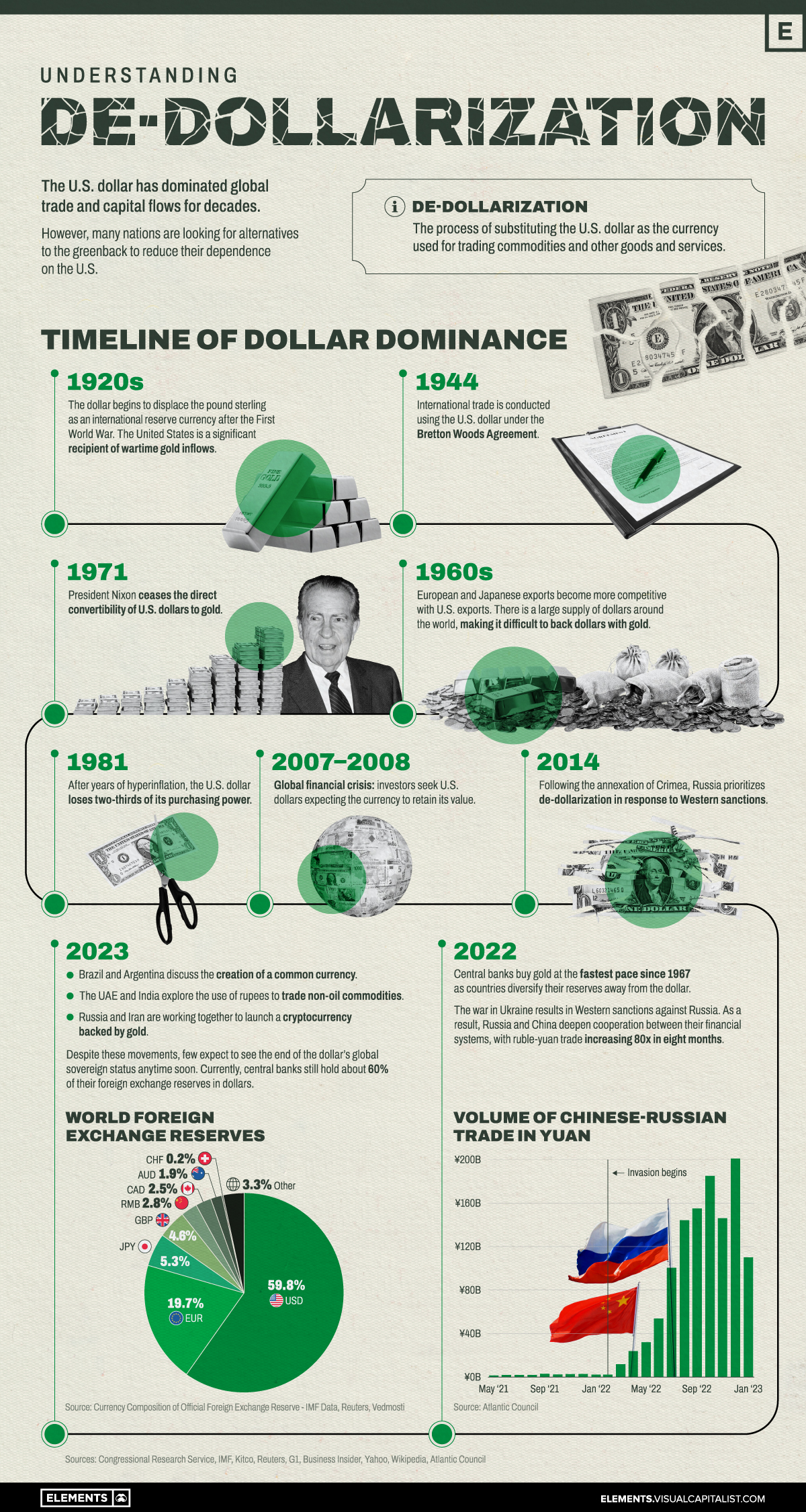

De-dollarisation

GS Paper III

Context: A rising number of nations are opting to conduct bilateral commerce in their own national currencies rather than the US dollar (de-dollarization).

What is de-dollarisation?

The process of countries reducing their reliance on the US dollar as a reserve currency, medium of exchange, and unit of account is referred to as "de-dollarization."

Why is the US dollar used so widely?

Dollar dominance: Following World War II, the US dollar took the place of the British pound as the world's preeminent currency. The Bretton Woods Agreement designated the dollar as the international reserve currency in 1944. Although the original Bretton Woods Agreement is no longer in effect, the dollar continues to be the world's reserve currency.

US trade deficit: The United States has had a continuous trade deficit for many years; the last time it had a trade surplus was in 1975. Due to the US's trade imbalance, the rest of the world has invested the extra money in US assets, such as debt instruments issued by the US government.

U.S. assets are widely used by investors: One of the main reasons why investors choose investing in U.S. assets is the high degree of trust that foreign investors have in the U.S. financial markets, maybe as a result of the "rule of law" in the U.S.

What is Reserve Currency?

Central banks and other monetary authorities hold reserve currencies as a means of facilitating international trade, regulating exchange rates, and boosting investor confidence.

These currencies are popular for keeping and carrying out foreign transactions because of their stability, liquidity, and widespread acceptability in global markets.

Central banks may also employ a reserve currency to affect their own domestic exchange rate and plan for future commitments under international debt agreements.

Global Efforts Towards Dedollarization:

A number of nations and areas have started down the path to dedollarization in recent years, motivated by a mix of geopolitical, economic, and strategic factors.

China, Russia, Brazil, and the European Union are notable examples of countries that have made efforts to lessen their reliance on the US dollar in international trade and financial markets.

Why are de-dollarisation attempts being made?

U.S. sanctions: The U.S. issued a number of measures that limited the use of the dollar to buy oil and other products from Russia. Many nations viewed this as an effort to weaponize the dollar.

American banks are required to clear all overseas transactions made in dollars, which provides the U.S. government considerable authority to monitor and regulate these transactions.

To undermine US hegemony: Some nations, including China and Russia, have worked to reduce the power of the US dollar in an effort to challenge American hegemony as well as to lessen the effects of US sanctions.

To encourage the use of their own currency: Other nations, notably those in the Eurozone, have embraced dedollarization in an effort to strengthen their position in the global economy and achieve greater financial independence.

Challenges Towards Dedollarisation:

Threat to Global Financial Stability: As nations rely less on the US dollar, changes in the structure of the world's reserve assets might cause capital flows to vary and asset values to fluctuate. These variations might lead to financial instability in the absence of proper policy coordination and risk management.

Alternative money: Coming up with a workable replacement for the US dollar is a difficult task. An alternative reserve currency must be supported by a strong economy, deep and liquid financial markets, and good monetary and fiscal policy frameworks in order to reach the necessary level of stability, liquidity, and acceptance. While the euro and the Chinese yuan have made progress in this area, no single currency currently fully satisfies these requirements.

Increased Volatility in Exchange Rates: Dedollarization may cause an increase in exchange rate volatility, especially in the early stages of the shift. Trade, investment, and capital movements may be impacted as a result, especially in nations with underdeveloped financial markets or few mechanisms for managing exchange rate volatility.

Should India Focus on De-dollarisation?

Benefits: It may increase monetary autonomy and decrease susceptibility to changes in US monetary policy, allowing them to better adapt policy measures to their own internal economic situations.

Additionally, the diversification of reserve currencies may act as a cushion against exchange rate fluctuations and reversals in capital flows, lowering the probability of financial crises and enhancing overall financial stability.

Challenges: Developing nations may see more exchange rate volatility as they move away from the US currency. This might have an impact on trade, investment, and capital flows.

Additionally, for nations with less developed financial systems, developing deep and liquid domestic financial markets—a requirement for currency internationalization—could prove to be a formidable challenge.

Additionally, the transition's potential costs, such as modifications to current trade and financial arrangements, could be high and put a strain on already scarce resources.

Way Forward:

These factors should prompt emerging nations like India to undertake dedollarization with caution and moderation. The potential advantages of lowering reliance on the US dollar must be carefully weighed against the dangers and expenses involved in making such a change.

Dedollarization offers prospects for a more diverse and robust global financial system, but it also poses considerable problems that must be properly handled to maintain both global financial stability and steady economic growth.

India and other developing nations must carefully balance the potential advantages and hazards of this shift.

Source: The Hindu

Oil and Gas Price Volatility

GS Paper III

Context: The current administration has taken a number of steps to safeguard Indian customers against fluctuations in the price of oil and gas abroad. This goal will be furthered by the recent Cabinet decision to adopt a number of crucial Administered Price Mechanism (APM) petrol price improvements. The goals of these changes are to safeguard Indians against high price volatility, encourage additional exploration and production (E&P) investments and innovation, and offer certainty for anticipated capex expenditures in gas-based sectors.

Reasons for oil and gas price volatility:

worldwide supply and demand: One of the main contributors to price volatility is the equilibrium between the worldwide supply and demand for oil and gas. Prices may go down if there is an excess of supply, while they may go up if there is a shortage of supply.

Geopolitical tensions: Trade conflicts and other political tensions between nations can have an impact on oil and petrol prices. For instance, prices may increase if a major oil-producing nation faces a danger of war or an interruption in supply.

Weather: Extreme weather occurrences, such as hurricanes or cold snaps, can affect the delivery and production of oil and gas, which can affect prices.

Economic expansion: Economic expansion may increase demand for oil and gas, which might raise prices. On the other hand, a downturn in the economy may result in less demand and lower prices.

OPEC decisions: By regulating production levels, the Organisation of the Petroleum Exporting Countries (OPEC) has a substantial impact on world oil prices. Prices may be impacted by OPEC decisions, like as output cutbacks or increases.

Measures taken by the Indian government to protect consumers from oil and gas price volatility?

Increasing the domestic Administered Price Mechanism (APM) gas allocation: This action was made to increase clarity for planned capital expenditure expenditures in gas-based industries and to redirect gas from non-priority sectors to the home and transportation segments.

Reforms to APM petrol pricing: The goal of shielding Indian consumers from severe price volatility would be further advanced by the recent Cabinet decision to adopt a number of crucial APM petrol pricing measures. In order to safeguard Indians from high price volatility and to encourage more innovation and investments in exploration and production (E&P), these changes accomplish two key objectives.

Benchmarking APM prices: The government made the decision to protect domestic petrol consumers and national oil companies from such volatility by benchmarking APM prices to a slope of 10% of Indian crude basket price, which will be determined on a monthly basis, along with a maximum price of $6.5/MMBTU and a minimum price of $4.5/MMBTU for nomination fields.

Fertiliser subsidy reduction: Following these reforms, there would likely be a more than 2,000 crore rupee annual decrease in fertiliser subsidies.

Investment in the E&P industry will also be encouraged by these changes, which will provide a floor price for mature fields of nomination and provide a 20% price increase for new nomination wells, while simultaneously providing a floor price for mature fields of nomination.

Expansion of the gas pipeline network and CGD stations: Since 2014, India has extended the length of its gas pipeline network, which will total 22,000 km by 2023 from 14,700 km. In India, the number of CGD-covered districts rose from 66 in 2014 to 630 in 2023, and the number of CNG stations went from 938 in 2014 to 5,283 in 2023.

Way forward for India’s oil and gas sector:

Encourage and promote domestic oil and gas production: To lessen reliance on imports and reduce price volatility, the government should continue to provide incentives for local oil and gas production. This might be accomplished by enacting more laws that are beneficial to investors, streamlining rules, and looking into undiscovered resources.

Create a comprehensive energy strategy: India must create a comprehensive energy policy with a distinct vision for the expansion and development of the industry. Future energy demands, technological developments, and environmental concerns should all be considered in this approach.

Boost infrastructure spending: To increase supply chain efficiency and lower transportation costs, the government should invest in creating essential infrastructure such as pipelines, terminals, and storage facilities. Additionally, it will make it possible for the nation to access more distant oil and gas reserves.

Encourage the use of alternative energy sources: Given the urgent need to reduce greenhouse gas emissions, India should encourage the use of alternative energy sources including solar, wind, and hydropower. In addition to assisting India in achieving its climate objectives, this will lessen its reliance on fossil fuels.

Transparency in pricing should be improved: India has to do this for the oil and gas industry. This will encourage healthy competition, level the playing field for all participants, and empower consumers to make knowledgeable choices.

In order to guarantee a steady supply of oil and gas, India needs enhance its relations with other nations, notably those in the Gulf area. Additionally, by diversifying energy sources, this will lessen reliance on a select number of nations.

foster innovation: To foster innovation and enhance the adoption of cutting-edge technology, the government should provide incentives for research and development in the oil and gas industry. This may aid in enhancing resource utilisation, lowering environmental impact, and improving extraction methods.

Conclusion:

It is good that India is making an attempt to shield its customers from fluctuations in global oil and petrol prices. This goal will be further advanced by the recent APM gas price changes, which will also encourage greater innovation and investment in exploration and production (E&P) and offer certainty for planned capital expenditures in gas-based sectors. India is well on its way to realising a gas-based economy as part of its larger energy transformation ambitions because to a rising demand for natural gas. The idea of an energy future for India that is cleaner, greener, and more sustainable is rapidly becoming a reality.

Source: The Hindu

Leveraging Public Distribution System

GS Paper III

Context: The fact that the purchase of wheat has reached 20 million tonnes (MT), which is an increase over previous year, must have relieved the Department of Food and Public Distribution (DoF&PD) and the Food Corporation of India (FCI). To the central pool, three states—Punjab, Haryana, and Madhya Pradesh—have contributed more than 98%.

Wheat production estimates:

Earlier estimates from the Ministry of Agriculture and Farmers' Welfare (MoA&FW) put this year's wheat production at 112 MT. The new projection is dubious, though, because of how unseasonal rains have affected wheat output.

Punjab: Punjab, one of the countries that contributes most to the purchase of wheat, is now evaluating the losses resulting from bad weather immediately before harvest. Interactions with Punjab Agriculture University (PAU), market workers, and farmers indicate that the output of wheat this year is higher than previous year despite the unseasonal rainfall.

Uttar Pradesh: Compared to Punjab, which produces around 18 MT less wheat, Uttar Pradesh produces roughly 35 MT. Although UP is expected to procure 3.5 MT of wheat, it has only acquired a pitiful 0.12 MT. Unless anything unexpected happens in May and June, the total amount of wheat purchased may fall considerably short of even 30 MT.

|

Food Corporation of India (FCI): Food Corporation of India (FCI) is a public sector organisation that falls under the Ministry of Consumer Affairs' Department of Food and Public Distribution.

In 1965, the Food Corporations Act of 1964 created the FCI, a statutory organisation. It was founded in the midst of a severe grain crisis, particularly in wheat.

Its main responsibilities include purchasing, storing, moving/transporting, distributing, and selling food grains and other goods. |

Challenges for providing nutritious food through PDS:

Infrastructure and supply chain: It is difficult to transport and store nutrient-dense foods like millets, pulses, and oilseeds due to a lack of adequate infrastructure and supply chains. This causes waste and spoiling, which eventually lowers the calibre of the food offered through PDS.

Cost: Providing nutrient-dense food through PDS may raise programme costs, which the government may find difficult to support over the long term.

Knowledge and demand: The average population is not aware of the advantages of nutrient-dense foods or the necessity of including them in one's diet. Additionally, there might not be enough demand for these products, which would result in poor offtake and waste.

Operational issues: For a PDS programme to be successful, a number of operational issues, such as the procurement, storage, and distribution of wholesome food products, must be resolved.

Political intervention: There may be political influence in the decision-making process when choosing which foods to include in PDS, which might result in a concentration on populist policies rather than wholesome foods. This might make the programme less effective.

Nutrition security through PDS and a help to climate resilient agriculture:

Achieving the twin goals of nutrition and climate resilience can be facilitated by include more nutrient-dense foods in PDS, such as millets, pulses, and oilseeds.

Food that is climate resilient should be promoted: Promoting the growth of food that is climate resilient, such as millets, pulses, oilseeds, etc., will help ensure a consistent supply of wholesome food.

Upgrading fair pricing stores to become Nutritious Food Hubs: Nutritious Food Hubs (NFHs) can be declared in at least 10% of fair price stores. These NFHs are able to consume fortified foods, such as bio-fortified rice, wheat, millets, pulses, oilseeds (especially soy products with 40% protein), fortified milk and edible oils, eggs, etc.

Targeted recipients may receive electronic vouchers that can be charged by the government three or four times per year (similar to an e-food coupon at a food court).

Government support for NFH upgrades: By receiving government support, NFHs can be improved, stimulating public demand for a wider variety of nutrient-dense foods.

Limiting rice purchases: Rice purchases would need to be limited, starting in areas where the water table has been dangerously dropping.

Giving a special package for carbon credits: To offer a special package for carbon credits for cultivating such crops, the federal government and the states must work together. As these crops would save that much in fertiliser subsidies from the federal government and state power subsidies, farmers could receive rewards of about Rs 10,000 per acre (to be split equally by the federal government and the state).

|

Public Distribution System In India throughout the interwar years, there was public distribution of necessities. However, PDS was born out of the dire food shortages of the 1960s and focuses on distributing food grains in urban areas with a lack of access to them.

PDS made guaranteed that food was available to urban customers and helped to significantly restrain the growth in food grain costs. In the 1970s and 1980s, PDS's reach was expanded to tribal blocks and areas with a high prevalence of poverty as the country's agricultural output increased as a result of the Green Revolution.

PDS is supplementary in nature and is not meant to supply a family or a particular sector of the population with all of their needs for any of the goods supplied under it.

The Central and State Governments share responsibilities for running PDS. The acquisition, storage, transportation, and bulk distribution of food grains to the State Governments are now the responsibility of the Central Government through FCI.

The State Governments are in charge of carrying out the operational duties, such as allocating resources within the State, determining which households qualify, issuing ration cards, and monitoring the operation of Fair Price Shops, among other things.

Wheat, rice, sugar and kerosene are now the commodities allotted to the States/UTs for distribution under the PDS. Pulses, edible oils, iodized salt, spices, and other commodities of mass consumption are also distributed by several States/UTs through PDS shops. |

Conclusion:

The Department of Food and Public Distribution's Chintan Shivir has a fantastic idea about using PDS to deliver more healthy food, but it faces a number of practical difficulties in making this vision a reality. The public may demand more varied and healthy food if at least 10% of fair pricing stores were upgraded to healthy Food Hubs. The purchase of rice must be limited, and farmers must be encouraged to plant millets, pulses, and oilseeds that are climate-smart and require less water and fertiliser.

Source: Indian Express

Golden Globe Race

GS Paper III

Context: By placing second in the Golden Globe Race (GGR), 2022, Abhilash Tomy, a former commander in the Indian Navy, accomplished the incredible achievement of accomplishing a solo round of the globe. He set the previous record in 2013 by sailing solo and unaided around the world aboard a sailboat. He set this record in even more difficult conditions.

What is Golden Globe Race?

The first iteration of the Golden Globe Race, a non-stop, solo, unaided sailboat race around the globe, took place in 1968-69.

Participants in the race must utilise vessels built to premodern criteria and must only use sextants and paper charts.

Modern navigational equipment cannot be used, and the use of satellite phones is severely restricted.

The sailing would follow a predetermined path and circle the three large capes.

Significance of his achievement:

In the GGR-2022, only three of the eleven competitors finished the race, and Kirsten Neuschafer became the first woman to triumph in a solo around-the-world yacht race.

The most "repaired" boat in the race was Tomy's, and the sailor who did it all fought against inconceivable sea conditions and a lack of sleep.

In the end, Tomy finished second to Neuschafer to become the first Asian to finish the 30,000-mile GGR.

Source: Indian Express