todays current affairs 13th september 2023

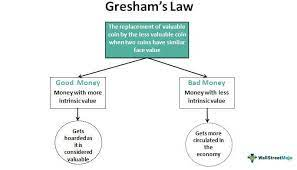

Greshams Law

GS Paper III (Economy)

Context: The statute, which bears Thomas Gresham's surname, was most recently put into effect last year during Sri Lanka's economic crisis. The exchange rate between the Sri Lankan rupee and the US dollar has been set by the Central Bank of Sri Lanka.

About Gresham’s Law:

The statute bears Thomas Gresham's name; he was an English businessman who provided financial guidance to the English Crown. It applies to commodities currencies as well as a variety of things and goes beyond paper money.

This adage exemplifies a phenomena that happens when fixed exchange rates set by governments deviate from market rates, resulting in the removal of undervalued money from circulation.

Gresham's Law comes into play anytime governments set prices arbitrarily, resulting in a commodity's undervaluation in relation to its market exchange rate. The commodity is forced off the official market by this undervaluation.

In such cases, the undervalued item is no longer accessible through official means and must be purchased on the black market.

When a country's prices are artificially depressed by the government, certain commodities may leave the country.

Application to Commodity Money:

When a government controls the exchange rate of commodity money, such as gold and silver coins, much below their market value, Gresham's Law is particularly obvious. In reaction, some people may hoard or melt these coins in order to sell them for their greater intrinsic worth than the rate established by the government.

Recent Example in Sri Lanka:

When Sri Lanka was experiencing an economic crisis and the central bank regulated the exchange rate between the Sri Lankan rupee and the US dollar, Gresham's Law was seen.

Though the black market rate suggested a greater value, the government regulated that the price of the US dollar should not exceed 200 Sri Lankan rupees. The U.S. dollar was forced out of the official foreign currency market as a result of the overvaluation of the rupee, which also caused a decrease in the availability of dollars.

People who needed US dollars for international transactions had no choice except to buy them on the illegal market for more than 200 Sri Lankan rupees each dollar.

Conditions for Gresham’s Law to Apply:

When governmental entities set and enforce fixed exchange rates between currencies, Gresham's Law is in effect.

For the law to be effective, the authorities must effectively enforce these rates.

Anti-thesis Concept: Thiers’ Law

The converse scenario happens when there are no fixed exchange rates set by the government. People frequently switch from currencies they think to be of lesser quality to those they believe to be of higher quality, which results in the domination of "good money."

Thiers' Law, so named in honour of French statesman Adolphe Thiers, is a supplement to Gresham's Law.

Source: The Hindu

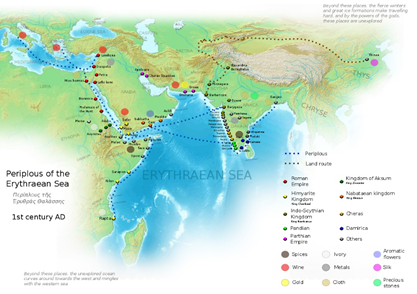

Ancient India-Europe Maritime Trade Route

GS Paper I (Art & Culture)

Context: The old maritime trade route that linked the Indian subcontinent and Europe is the historical origin of the India-Middle East-Europe Economic Corridor, which was unveiled during the G20 Summit.

India- Europe: Glimpse into Historical Trade Route

Early discoveries revealed commerce between Rome and India during antiquity. The 1930s and 1940s investigation at Arikamedu by Sir Mortimer Wheeler provided evidence of Indo-Roman trade in the first century CE.

Current archaeological digs, including those at Muziris in Kerala and Berenike in Egypt, continue to produce fresh information.

Early interpretations, nevertheless, frequently ignored the role played in this commerce by Indian traders and ship owners. Our knowledge of this prehistoric commerce network has been widened and rectified by recent finds.

Recent estimates demonstrate the enormous scope of the Red Sea commerce, which is supported by the Muziris Papyrus. Up to one-third of the money coming into the Roman exchequer may have come from customs charges on products coming from Ethiopia, Persia, and India.

Details unveiled by Muziris Excavations:

The Muziris Papyrus included information on a cargo's value and highlighted its huge value, stating that the cost of only one cargo would be enough to buy a magnificent home in central Italy or prime farmland in Egypt.

On this single shipment alone, import taxes were collected in excess of two million sesterces. Using these numbers as a starting point, one might extrapolate that yearly Indian imports into Egypt were probably worth more than a billion sesterces, with tax authorities earning 270 million sesterces.

The fact that their profits were greater than those of the whole subject countries highlights the crucial significance that this commerce route played in maintaining the Roman Empire's extensive conquests and legions.

Trade details:

The Red Sea served as a maritime thoroughfare between the Roman Empire and India throughout the first and second century CE. Every year, this waterway saw hundreds of ships moving in both directions.

Indian goods like fragrances, ivory, jewels, gemstones, and exotic creatures like elephants and tigers were in high demand among the Romans. The popular Indian export of pepper, which was used in Roman cooking, was highly sought-after.

Rome only sent a little amount of products to India, with the main export being gold. One prominent exception was Indians' appreciation of Roman wine.

Pre-Common Era Trade:

Evidence points to the existence of an Indian diaspora in the Middle East between 3300 and 1300 BCE, during the Indus Valley Civilization. Early trade was limited to lesser amounts of products and largely coastal.

Large freight ships that connected the subcontinent and the Roman Empire directly helped trade grow greatly throughout the Roman era. Romans were crucial in the industrialization of this trade.

The path to India was opened up by the Roman conquest of Egypt in the first and second century CE, which greatly increased commerce.

Organization and Duration of Journeys:

Contracts were made between shippers in Alexandria and Indian merchants in Kerala. Similar to contemporary methods, goods were carried in containers with references to insurance.

Indians were able to negotiate the path well because they were aware of the seasonal rhythms of the monsoon winds. It took around six to eight weeks to get to Egypt, depending on how well the winds were blowing.

While they waited for the wind patterns to change, the Indian diaspora rented homes in Egyptian ports, bringing Indian culture to these areas.

Roles of Indians in the Trade:

Ajanta paintings and early Indian currency designs with ships provide evidence that Indian rulers were interested in sailing.

In the Hoq caverns on the island of Socotra, Indian seafarers, particularly Gujaratis from Barigaza (modern-day Bharuch), wrote graffiti emphasising their active participation in the trading network.

Comparing with the Silk Road:

The Indian subcontinent and its ports, which were formerly Asia's old economic and cultural centre, were crucial to maritime East-West commerce. The idea of the "Silk Road" is somewhat modern, and it represents the old trading routes incorrectly.

The idea of the Silk Road did not exist in prehistoric or mediaeval times; it was first proposed in the late 19th century. It rose to prominence in the 20th century, promoting idealised notions of East-West connectedness.

The Silk Road has become politically charged as a result of Chinese President Xi Jinping's Belt and Road Initiative, becoming a key tenet of Chinese foreign policy.

Source: The Hindu

Natural Disasters

GS Paper III (Disaster Management)

Context: States frequently ask the federal government for help after natural catastrophes. The chief minister of Himachal Pradesh recently pushed for the classification of the catastrophe as a "national disaster" and asked for a special package of disaster aid.

Natural Disaster Mitigation in States:

The legal basis for dealing with catastrophes, whether they are man-made or natural, is provided by the Disaster Management Act of 2005.

A "disaster" is defined as an occurrence that results in a significant loss of life, human suffering, property damage, or environmental degradation that exceeds the community's capacity to cope.

The NDMA, chaired by the Prime Minister, and the State Disaster Management Authorities (SDMAs), headed by Chief Ministers, were formed under the Act. In India, a comprehensive system of disaster management is comprised of several organisations and district-level agencies.

The NDRF, which consists of multiple battalions or teams in charge of on-the-ground relief and rescue operations in different states, was established as a result of the Act.

Understanding the National Disaster Relief Fund (NDRF):

The 2005 Disaster Management Act makes mention to the NDRF, which is essential to disaster assistance.

The main resources for reacting to declared disasters are the state-specific SDRFs. In general states and northeastern and Himalayan states, the Central Government provides 75% and 90%, respectively, to SDRFs.

Following notification of disasters including hurricanes, droughts, earthquakes, fires, floods, tsunamis, and more, SDRFs are allotted for rapid relief operations.

The National Disaster Response Fund (NDRF) can offer additional central help in the case of a catastrophic disaster when state SDRF funds are insufficient.

Who determines a Severe Calamity?

States have a set process for determining what constitutes a "severe" disaster. This entails sending a document outlining sector-specific harm and funding needs. On-site damage assessment is performed by an interministerial central team.

These assessments are reviewed and reports are provided by certain committees. The immediate relief amount that will be provided from the NDRF requires approval from a High-Level Committee.

Calamities are categorised as "severe" based on a variety of variables, including their severity, scope, aid requirements, and more.

Additional Funds for Disaster Mitigation:

Budgetary allocations include money for the NDRF and SDRFs that are set aside for mitigation, rebuilding, and readiness.

A new approach for allocating funds on a state-by-state basis was adopted by the 15th Finance Commission, which took into account variables such prior spending, risk exposure, hazard, and vulnerability.

Funds from the NDRF and SDRF are distributed in two equal installments, usually with conditions like obtaining Utilisation Certificates. However, these conditions may be waived in cases of extreme urgency.

This fund helps with initiatives like public education and forest restoration. The 15th Finance Commission provided a budget of Rs 32,030 crore for it.

The Rs 13,693 crore NDMF is allocated for national disaster mitigation initiatives.

Source: The Hindu

Non-Reciprocity

GS Paper III (Science & Technology)

Context: A fundamental tenet of physics known as reciprocity states that if a signal can go from point A to point b, it must also be able to travel in the other direction. This simple idea is important in many facets of daily life and is the cornerstone of several technical innovations and difficulties.

Exploring Reciprocity:

According to the principle of reciprocity, a signal that is sent from a source (Point A) to a destination (Point B) may also go in the other direction by simply switching the locations of the source and destination.

Simple situations, like lighting a candle or looking at something under a streetlight, show reciprocity in action.

Some scenarios contradict common sense, such as seeing someone walk in the dark or watching interrogation sequences in films when one side can see through a window but the other cannot.

Applications in Antennas and Beyond:

Reciprocity is essential to antenna technology because it makes it possible for signals to be sent and received. Reciprocity is used by engineers to evaluate the reception quality of antennas, streamlining the testing procedures for MRI scanners, seismic surveys, radar, and sonar.

Reciprocity improves signal reception, but it makes espionage difficult since it makes it possible to intercept signals from an enemy base while potentially disclosing one's own position.

Scientists use gadgets made of parts with specialised qualities to combat reciprocity. Signals may now only travel in one direction thanks to these gadgets, which breach reciprocity.

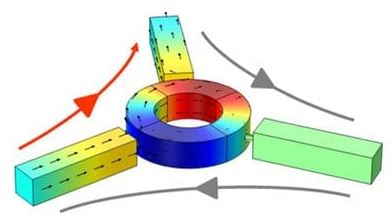

Diverse Ways to Break Reciprocity:

This technique breaks the reciprocity of electromagnetic waves using wave plates and Faraday rotators.

Modulation provides a way to regulate signal transmission by repeatedly changing the time or space dimensions of a medium.

Nonlinearity is another way to breach reciprocity, and it may be introduced by changing a medium's characteristics according to the signal's amplitude and direction.

Revolutionizing Technologies:

Non-reciprocal devices are used in quantum computing to effectively detect quantum states by amplifying signals.

Non-reciprocal parts, some as tiny as a hair strand multiplied by 1,000, are included in the movement towards nanoscale and microscale technologies. These tiny gadgets promise to make a difference in industries like self-driving cars, where effective signal monitoring is crucial for security.

Source: Indian Express

Picoflare Jets

GS Paper III (Science & Technology)

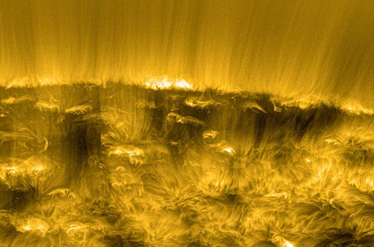

Context: The Picoflare jets bursting from the sun's outer atmosphere have just been revealed by the Solar Orbiter Aircraft, a joint project of NASA and the European Space Agency.

What are Picoflare Jets?

Picoflare jets, which were seen in the middle of coronal hole emissions, are small in size but incredibly powerful.

Scientists have estimated that they contribute a significant amount of the energy in the solar winds, despite the fact that they are fleeting.

Due to their energy levels, which are typically one trillionth of the enormous energy potential of solar flares, these solar emanations have been given the term "picoflare jets."

Strong solar winds may cause auroras in the Polar Regions, alter the magnetic field of the planet, and endanger electrical equipment on satellites and terrestrial circuits.

About Solar Orbiter Aircraft:

The Solar Orbiter Aircraft, which will be launched in 2020, is on a mission to photograph the Sun at a distance never before reached by a spacecraft.

The spacecraft is ready for thorough solar investigation since it has four sets of in situ equipment and six remote-sensing instruments.

The Solar Orbiter Aircraft has two main goals: to investigate the secrets of the solar corona, the Sun's upper atmosphere, and to observe the Sun's 11-year cycle of magnetic activity ebbs and flows.

Source: Indian Express

Facts for Prelims

Bharat Bill Payment System (BBPS):

For NRIs in the UK, India will soon permit cross-border bill payments via BBPS.

NRIs residing in Oman, Kuwait, the United Arab Emirates, and Bahrain already have access to the BBPS.

India's bigger push for digital payments includes enabling cross-border bill payments.

A centralised system for paying recurring bills (such as those for electricity, gas, DTH, water, postpaid telephone service and fastage) is known as BBPS.

The National Payments Council of India (NPCI) launched it.

A group of banks owns NPCI, which was founded with the goal of building reliable payment and settlement systems.

UPI has also been introduced.

Goa Roadmap for Tourism:

The "Goa Roadmap for Tourism" was emphasised in the G20's Delhi Declaration as a means of achieving the SDGs.

It lists five tourism-related priority areas: green tourism, digitalization, skills, tourism MSMEs, and destination management.

The 'Travel for LIFE' project, which encourages travellers and tourism-related businesses to take little steps that have a big impact on environmental and climate change action, was also included in the Delhi Declaration.

Additionally, the G20 Tourism and SDG Dashboard, which will operate as a worldwide repository exhibiting best practises and case studies of sustainable tourism practises and policies from G20 nations, was established by the Ministry of Tourism and UN World Tourism Organisation.

Marrakesh:

A 6.8-magnitude earthquake struck Morocco, with the centre not far from Marrakesh.

West of the Atlas Mountain foothills is where Marrakesh is located.

The Medina district of Marrakech has been named a UNESCO World Heritage Site.

In 1994, the Marrakesh Agreement, which founded the World Trade Organisation, was signed.

The Marrakesh Treaty, which is overseen by the World Intellectual Property Organisation, facilitates the creation and worldwide transfer of publications that have been particularly modified for those who are blind or have visual impairments.

Copyright 2022 power by Ojaank Ias